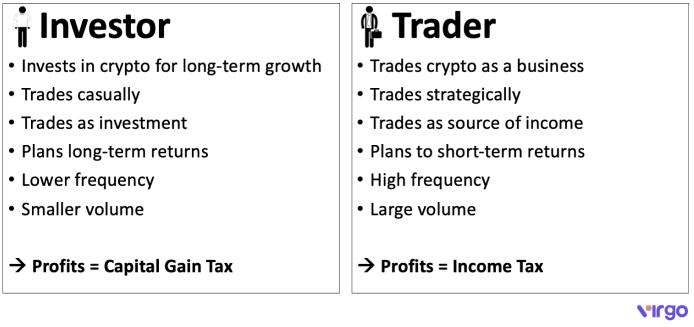

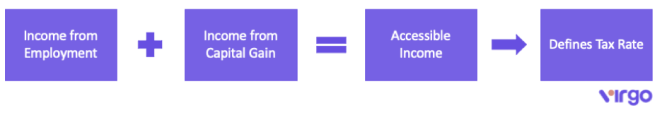

Before getting into all the details, it is important to understand that there are two different ways the ATO can look at people using crypto. Depending on how you are seen, this will have an impact on what kind of tax you have to pay and how much.

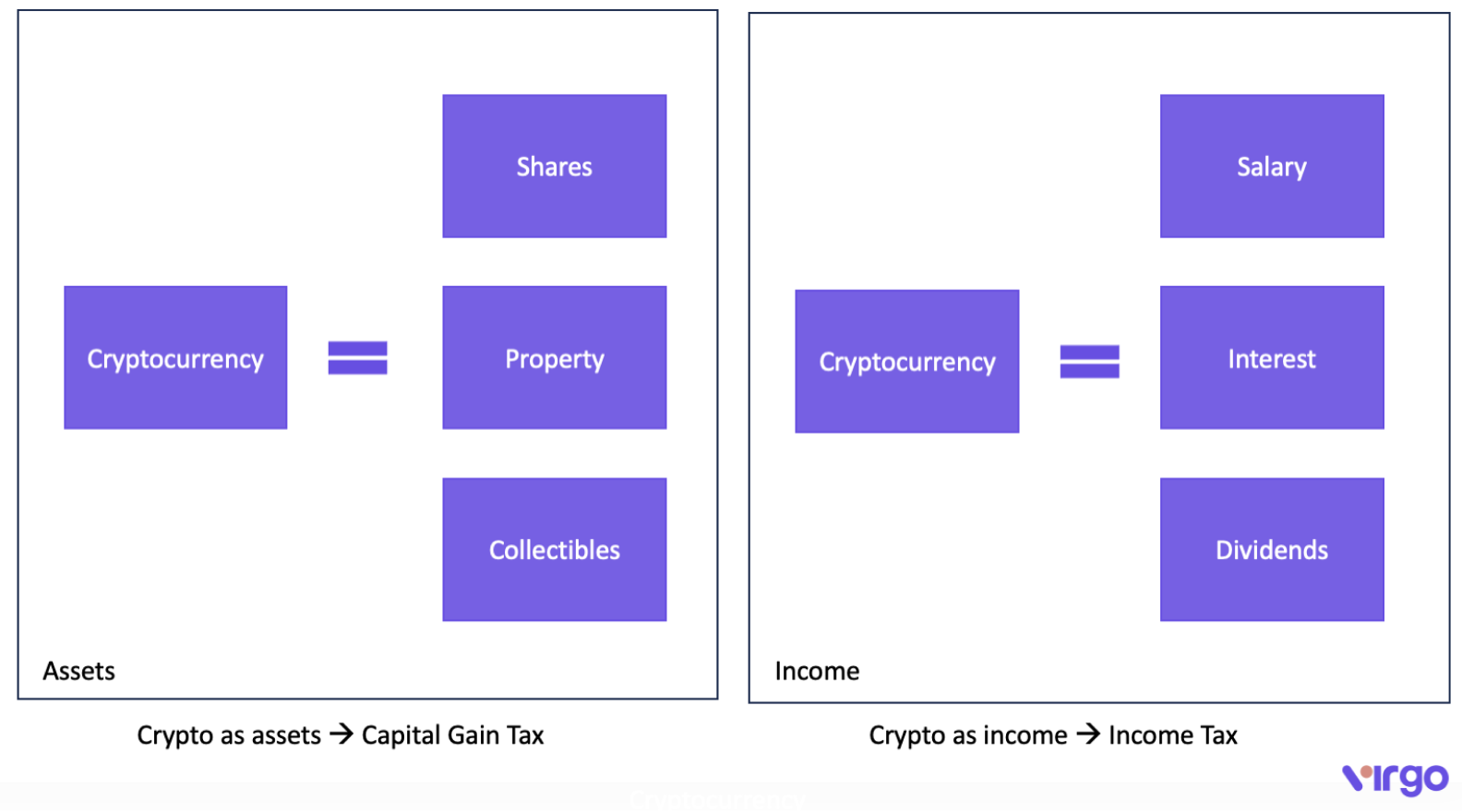

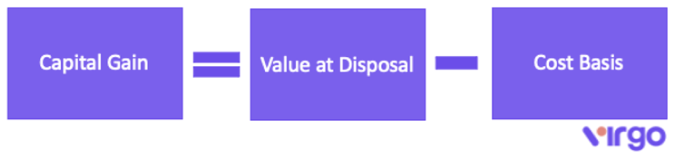

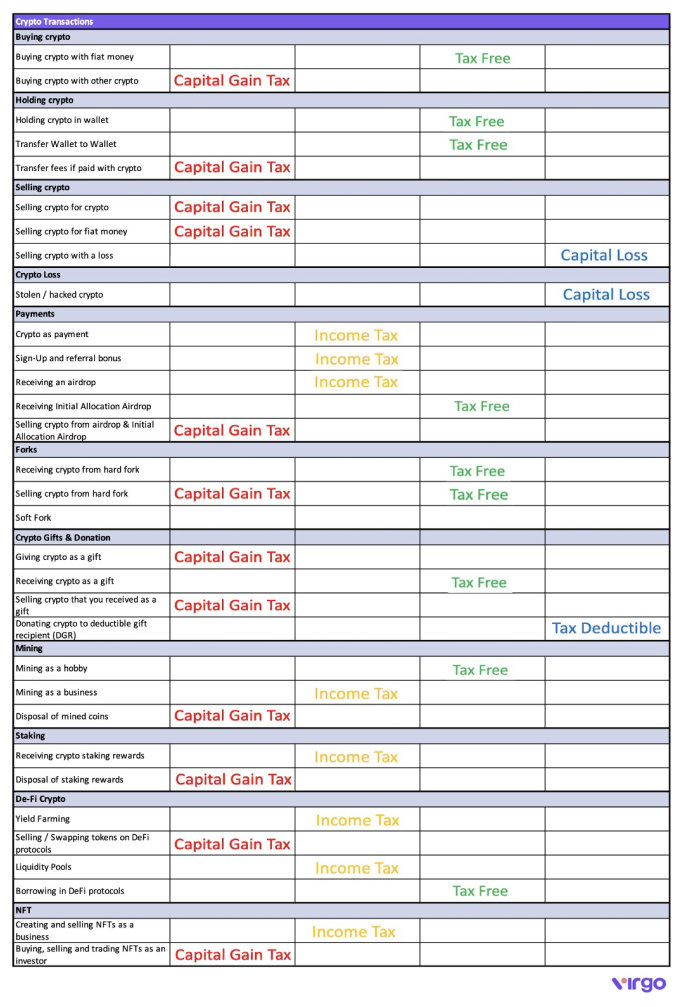

An investor is someone who purchases crypto with the expectation of long-term growth in the value of the asset, they are not trading crypto for short-term profit. In short, it is seen as an asset similar to property or shares and is taxed as Capital Gain Tax.

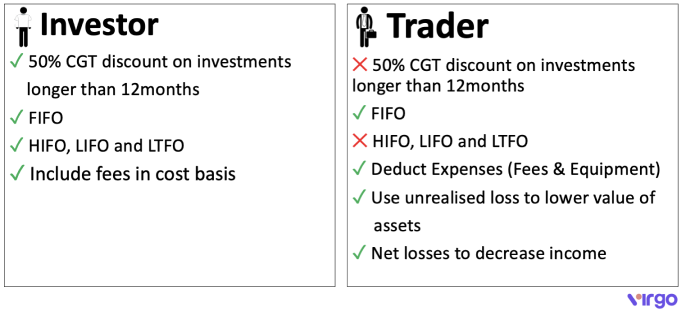

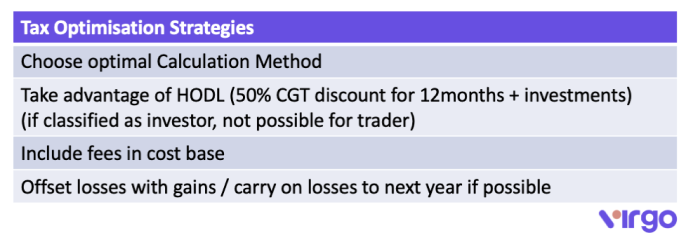

This leads to the advantage of having the possibility of reducing the CGT by 50% when holding crypto for at least 12 months and 1 day before selling.

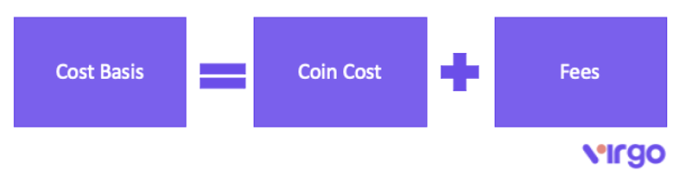

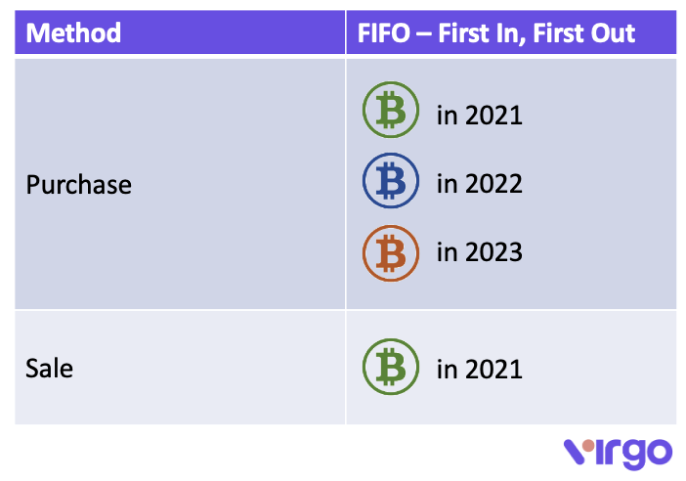

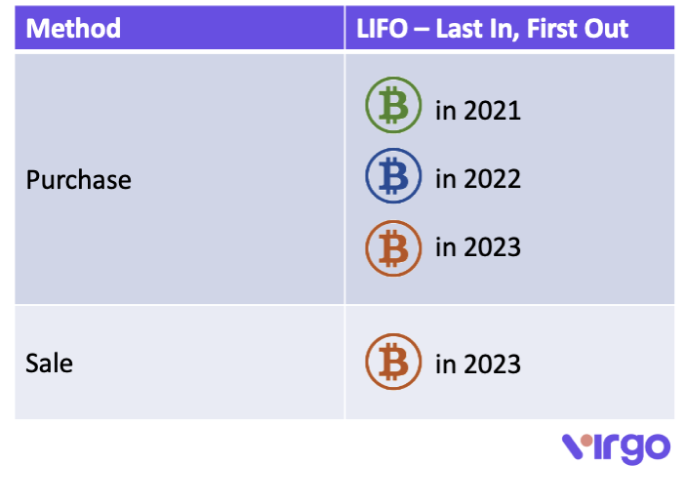

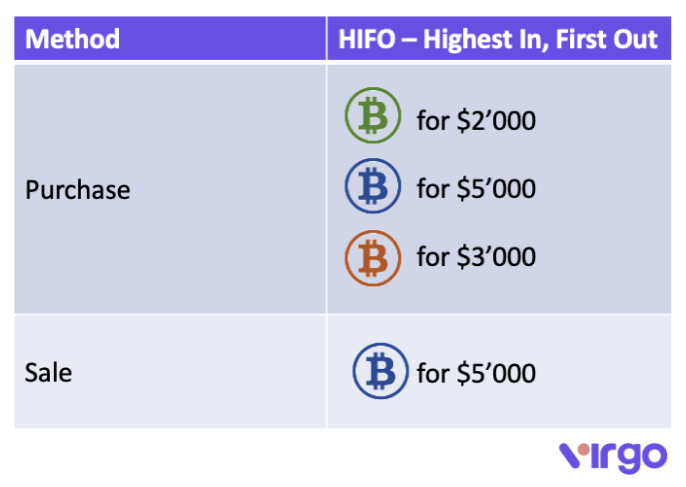

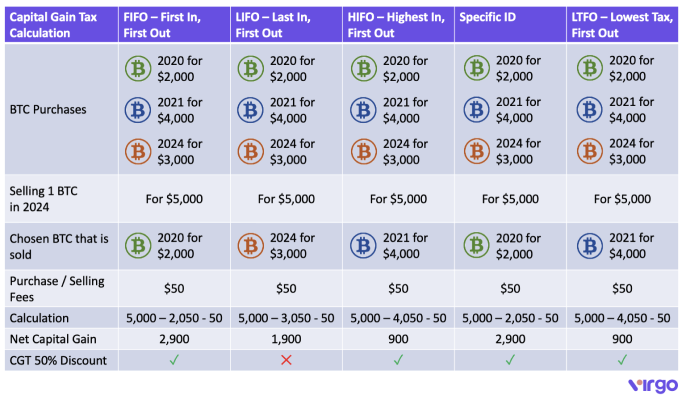

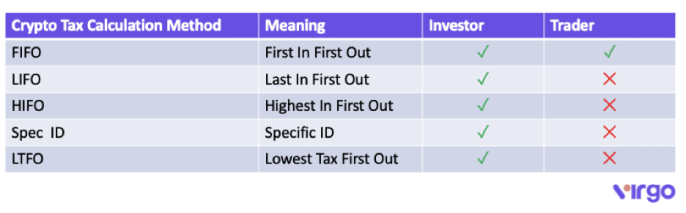

Additionally, there are four different methods of calculating your net capital gain: FIFO, HIFO, LIFO, and LTFO. These methods will be explained further.

Contrary to a crypto investor, a crypto trader is someone who actively trades crypto with the expectation of making short-term profits. A crypto trader is in the business of trading crypto and their crypto is treated as trading stock. This means that there is likely to be a business plan and the sophistication of record-keeping is higher. Therefore, profits from a trading activity are treated as Ordinary Income.

One major disadvantage of this definition is that a trader is not able to claim the 50% CGT discount even if coins are kept for longer than 12 months and 1 day. It only limits the net capital gain calculation method to FIFO, instead of having other alternatives.

However, there are some advantages as fees and equipment are considered to be expenses for the business and are deductible. Additionally, unrealized losses can effectively be used to lower the value of assets without having to sell them. Net losses can be used to decrease the income and therefore, reduce the amount of tax paid.

The majority of this article is based on crypto tax on an investor basis, assuming that businesses tend to have their professional tax accountant.

While the above table indicates how the ATO might classify you, this can sometimes be tricky. The ATO provides more information on how they define investors and traders.

If this still doesn’t clear things up, it’s advisable to get in touch with a professional tax accountant.

Both definitions have their advantages and disadvantages, which we will present now.